The Importance of Financial Planning for Tech Executives

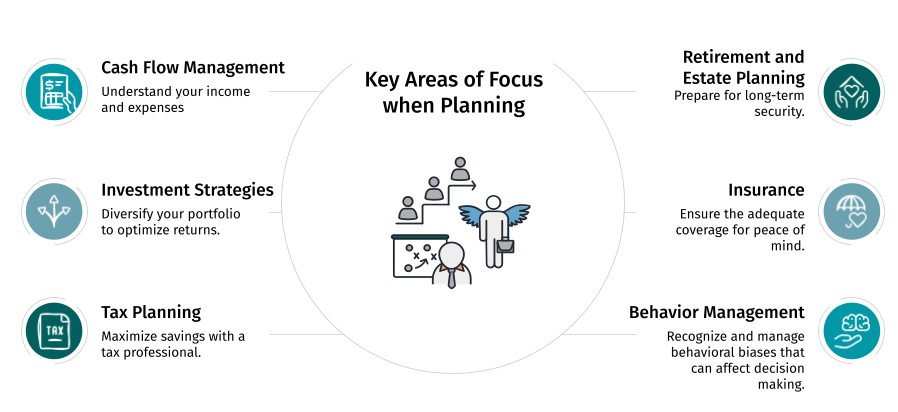

A solid financial plan is essential for tech executives seeking peace of mind and alignment with their aspirations. Here’s why it matters:

1. Navigate Unpredictable Wealth

In the tech industry, wealth often comes in sudden bursts from events like IPOs or acquisitions. A financial plan helps you manage these windfalls effectively, ensuring you can sustain your lifestyle and invest wisely.

2. Optimize Taxes

The tax landscape for tech professionals can be complex. A comprehensive financial plan allows you to leverage deductions and credits, minimizing your tax burden legally.

3. Mitigate Risks

The tech sector is inherently risky. Financial planning enables you to build a safety net that protects your assets during downturns or unexpected challenges.

4. Achieve Your Goals

Whether it’s early retirement, philanthropy, or securing your family’s future, a financial plan provides a roadmap to reach your objectives and realize your dreams.

5. Strategic Exit Planning

For entrepreneurs, having a well-thought-out financial plan is crucial for a successful exit. It maximizes your gains and ensures a smooth transition.

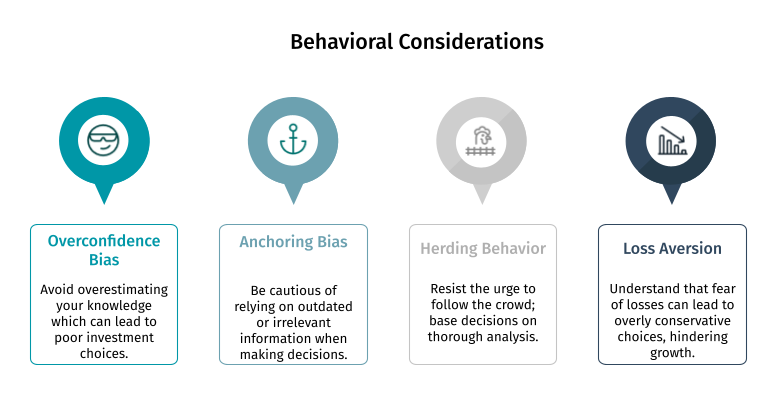

Understanding and managing these behavioral biases is crucial for implementing your plan and making informed investment decisions.

Start Planning Today

The earlier you develop a financial plan, the better prepared you’ll be to seize opportunities and manage challenges in the tech world.

Execution is key: implement your plan with a

clear timeline and

disciplined approach. Consistent action will yield the best long-term results, ensuring you stay on track to meet your

financial tranquility.

Contact the Prospera team to discuss your financial plan and start your journey toward lasting success.