The Wealth Allocation Framework: A Structured Overview

Conceptualized by Ashin Chhabra, the Wealth Allocation Framework provides a clear and comprehensive understanding of an investor's wealth, enabling tailored financial strategies that prioritize personal goals while managing risk effectively.

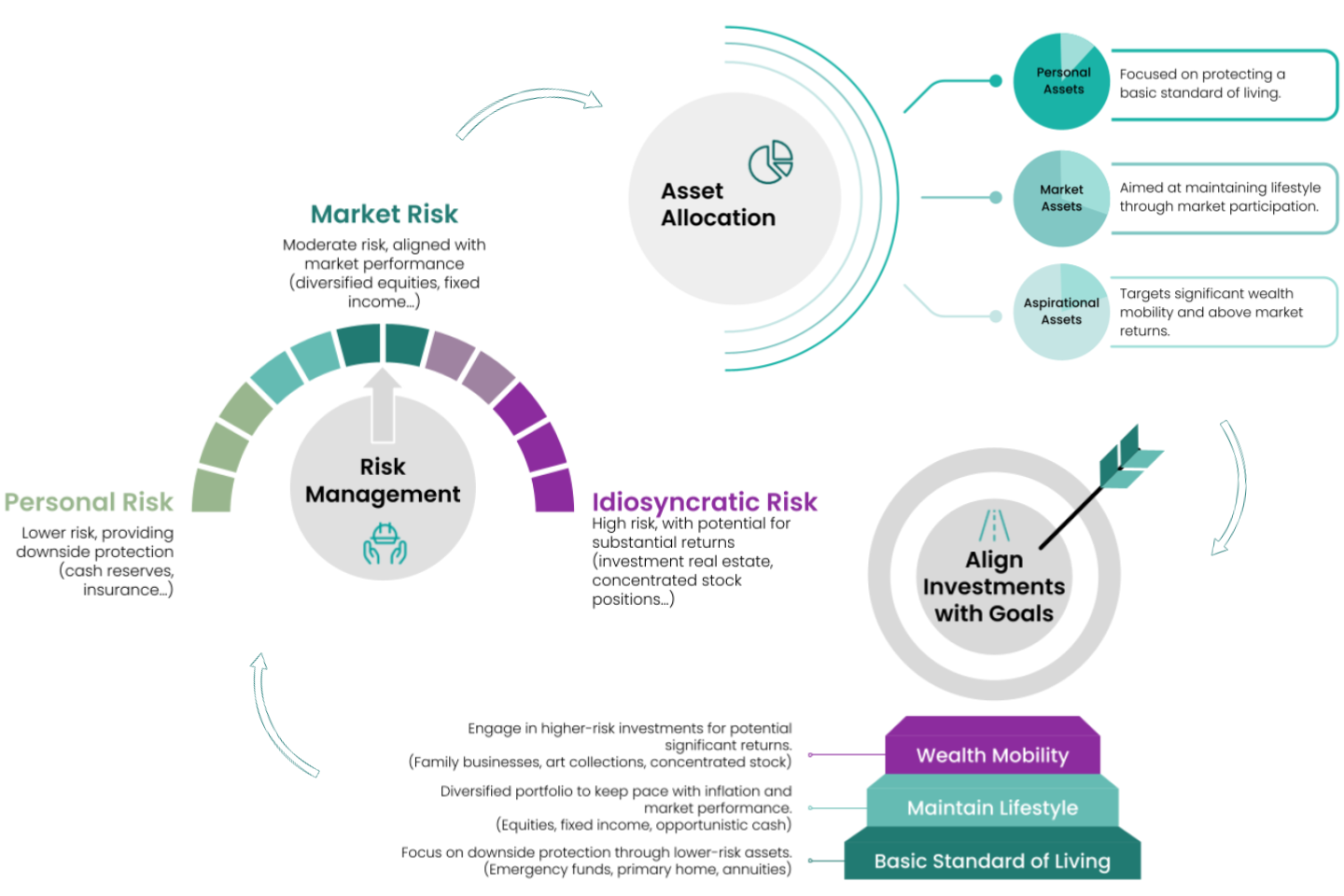

The framework starts by segmenting wealth into distinct categories, depending on how you plan to use it and when you’ll need it. Then it sorts assets into three risk types, each serving a specific purpose: Personal Risk, Market Risk and Aspirational Risk.

This structured and holistic approach helps investors align their resources with their individual objectives. Let's break it down!

The framework transforms a static wealth statement into a dynamic tool that highlights risk allocation in relation to personal goals where investors can evaluate their risk tolerance against their goals, ensuring resources and risks are aligned.

As life changes, this approach gives room for regular assessments allowing the necessary and desired adjustments ensuring continued progress toward your tranquility.

At Prospera, we leverage the Wealth Allocation Framework to offer tailored financial strategies for tech executives and entrepreneurs.

Our advantage comes from our more than two decades of experience as tech entrepreneurs and investors. We understand the complexities of managing significant equity stakes and high-risk investments. We help you apply the framework’s principles to reduce concentration risk, balance your portfolio, and ensure that your financial plan aligns with your life goals.

Plan your Tranquility with Prospera.