Why Reviewing Your Financial Plan is Essential for Tranquility

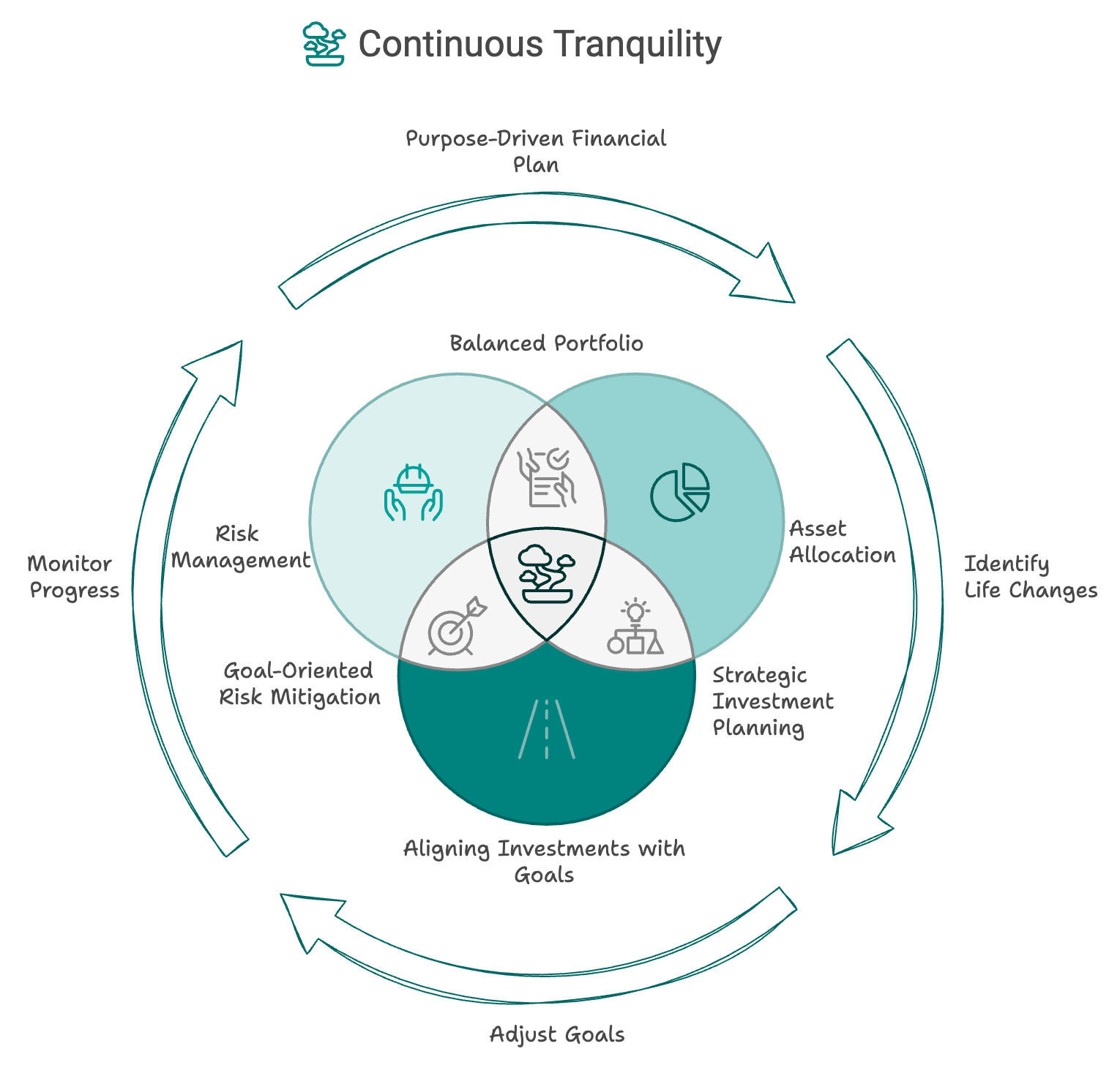

Financial planning isn't a "set it and forget it" activity. Life evolves, and your financial goals and strategies should evolve with it. Whether you're an entrepreneur, a tech executive, or someone managing wealth from other sources, a strong financial plan can be your map to tranquility. However, like any good map, it needs to be updated regularly to reflect changes in your life, career, and aspirations.

Over time, your circumstances, goals, and even the broader economic environment will shift. These changes, if not reflected in your financial plan, can undermine your sense of security and stability.

A well-designed plan can offer you peace of mind by helping you see the full picture of your financial life—your assets, liabilities, income sources, and goals—all in one place. This clarity allows you to make informed decisions and feel confident in your financial future.

Here’s how you can use your financial plan to create and maintain tranquility:

1. Clarity and Confidence

A thorough financial plan provides a roadmap for achieving your goals. By knowing where you stand and what steps are necessary to reach your destination, you can approach financial decisions with confidence. The clarity it provides helps eliminate anxiety about unexpected expenses or changes in your financial situation.

2. Alignment with Life’s Purpose

Financial planning is not just about numbers—it’s about aligning your wealth with your values and purpose. Whether your goal is to provide for your family, build a business, or retire early, your plan should be designed to support these aspirations. A periodic review ensures that your investments continue to align with your evolving life goals.

3. Achieving Balance

A balanced financial plan integrates both short-term needs and long-term aspirations. While you may be focused on accumulating wealth in your career, it’s essential to ensure that your plan also accounts for lifestyle goals, like family time, travel, and health.

Having a trusted financial advisor can play a crucial role in helping you periodically review and adjust your financial plan. A professional can provide valuable insights, help you navigate complex financial situations, and offer strategies that are tailored to your unique needs.

At Prospera, our holistic approach to wealth management ensures that your financial plan evolves with you. We help tech executives and entrepreneurs optimize asset allocation, manage risk, and achieve their life’s purpose. With expert guidance and continuous support, you can ensure that your financial decisions reflect your values and goals—giving you the peace of mind to focus on what truly matters.

Whether you’re managing complex compensation packages, facing career transitions, or preparing for a major life event, your financial plan should be a dynamic reflection of your personal aspirations.

So, take the time to review your financial plan periodically—it’s the best investment you can make in your long-term peace of mind.

If you’re ready to align your financial plan with your life goals and ensure ongoing tranquility, our team at Prospera is here to help.

Let’s embark on this journey together.

Plan your Tranquility with Prospera.