Calibrated Risk: The Real Game of Long-Term Investing

Why Smarter Investing Isn’t About Avoiding Risk, It’s About Calibrating It

At Prospera, we often remind clients that the biggest investment mistake isn’t taking too much risk, it’s misunderstanding what risk really is.

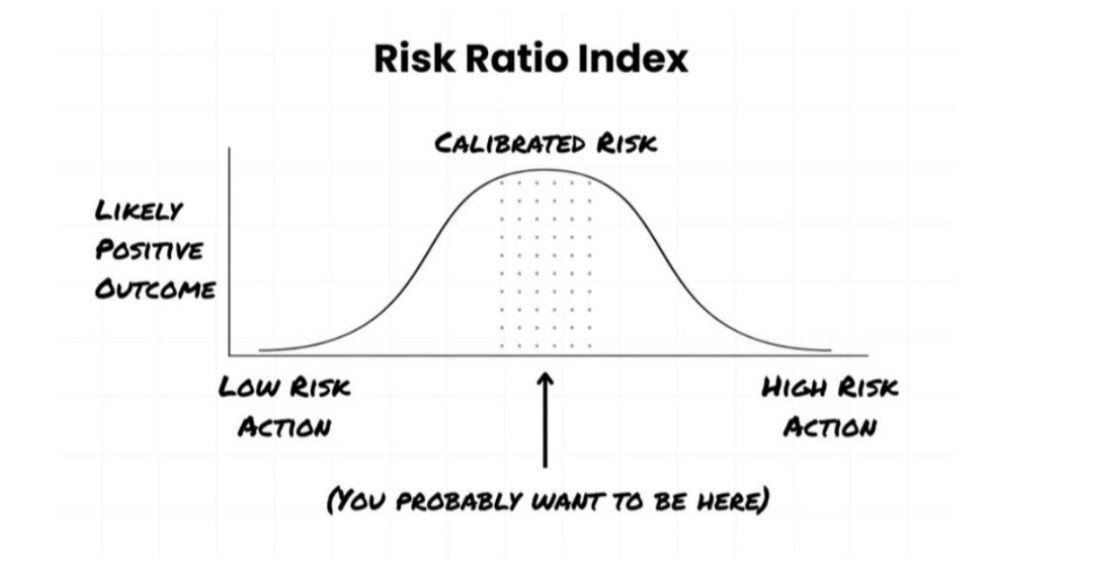

Most people treat risk like it’s binary: you’re either being risky or playing it safe. But that framing is not just simplistic, it’s dangerous. Real risk lives on a curve, not a switch. And the goal isn’t to avoid risk, but to calibrate it.

Why “Safe” Isn’t Always Smart

Imagine a curve with three zones:

- Far Left:

Inaction Disguised as Safety

This is where many investors hide. It feels safe, but often comes at the cost of growth. You avoid decisions that might look risky, but in doing so, you take on long-term risks that quietly compound, like inflation eroding cash or portfolios missing innovation cycles. Bill Perkins calls this ego risk: the fear not of losing money, but of looking foolish. - Far Right:

High-risk bets with Long Odds

These are moonshots, big, flashy, high-risk moves that might hit big but usually don’t. The lottery ticket mentality. It works for a lucky few, but for most, it’s gambling dressed up as boldness. - The Middle:

Calibrated Risk

This is where smart, asymmetric moves live. You’re not blindly swinging, and you’re not frozen in fear either. You’re stepping into uncomfortable, but potentially rewarding, decisions: diversifying away from a concentrated stock position, starting a side business, buying into a private investment with a strong thesis, or simply staying invested through volatility.

This is where most real wealth is built. Not by playing defense, and not by taking wild swings, but by investing consistently with real upside.

The Risk Ratio Index: Not Too Safe. Not Too Wild. Just Right.

Risk isn’t something to eliminate, it’s something to manage with intention.

The Risk Ratio Index isn’t about choosing safety. It’s about asking the right question:

“What kind of risk am I taking?”

At Prospera, we help you calibrate that risk in line with your personal goals, your timeline, and your ability to stay the course. We help you navigate the noise, think asymmetrically, and compound your capital where it matters most.

The right level of discomfort, applied in the right direction, at the right time, that’s the real game.

Stay disciplined. Stay invested. Stay calibrated.

Plan Your Tranquility.