When Indicators Flip: A Lesson in Perspective

The indicator changed, but how much did the market?

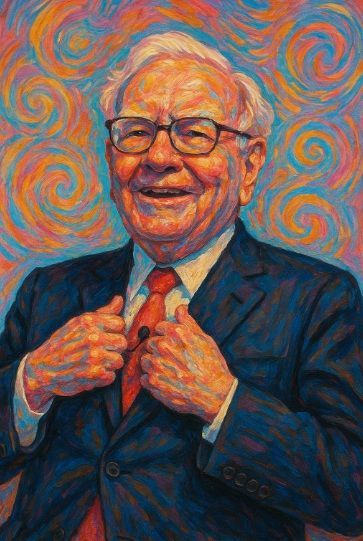

Today, while reading the news on Bloomberg, I saw a report that the Buffett Indicator, Warren Buffett’s well-known valuation metric comparing the total U.S. stock market to GDP, had fallen back to levels that some view as a buy signal.

It reminded me of a conversation I watched a few months ago between two friends debating the state of the market. One of them pointed to the Buffett Indicator as a reason to avoid investing in equities. At the time the indicator was above 2.0x, signaling that stocks were expensive.

Now, just four months later, that same indicator has fallen to around 1.8x and is being interpreted as a buy signal. And yet, the S&P 500 today is only 4% below where it was in late December.

That’s a small change in pricing for such a major change in narrative, and it all happened in a relatively short period of time.

What Causes the Indicator to Shift?

It’s easy to assume that valuation ratios move purely because stock prices rise or fall, but in reality, multiple underlying forces can drive these shifts, sometimes giving the impression that the market is suddenly cheap or expensive when the price action has been minimal.

The Buffett Indicator, for example, is influenced by market capitalization and GDP, but also indirectly reflects the equity risk premium, which can shift meaningfully due to changes U.S. Treasury yields, even if stock valuations were to stay flat. Beyond that, corporate earnings growth, inflation expectations, interest rates, sector weightings, and even index composition all play a role. Some of these inputs are forward-looking (such as stock prices), while others, like GDP or reported earnings, are lagging or revised over time. Because of this mismatch in timing and visibility, valuation indicators can often be distorted by factors that aren’t immediately obvious to the investor.

In short, valuation indicators reflect a moving target, shaped by a complex set of economic and financial dynamics, not a single, fixed truth about market opportunity.

What’s the Better Approach?

Rather than letting a single indicator dictate an all-or-nothing stance, a more effective strategy is to focus on building a diversified portfolio aligned with your long-term objectives.

Diversification helps manage risk across different economic and market environments, acknowledging that no one metric or forecast can consistently predict what comes next. Even more powerful is approaching investing through a systematic, disciplined process. Regular contributions over time, such as through dollar-cost averaging, also help to remove the pressure of trying to time the market and help smooth out the effects of volatility. Instead of reacting to every market signal or narrative shift, you’re following a plan designed to work across cycles.

Ultimately, successful investing isn’t about perfectly interpreting valuation signals in real time. It’s about staying invested with intention, using structure and perspective to navigate uncertainty, and allowing time and consistency to do the heavy lifting.

Plan Your Tranquility.